Beyond ESG and into impact investment we help to answer the most relevant question about early opportunity recognition using our opportunity recognition framework.

With our impact investment consulting we create alpha for our clients.

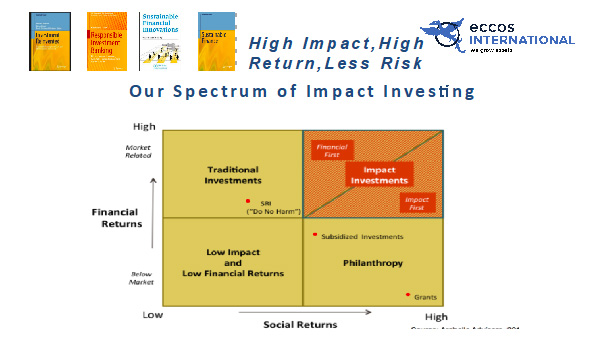

Impact investors are seeking to intentionally create positive impact on climate, biodiversity, ecosystems and society alongside creating risk adjusted returns.

Our approach falls into two areas.

At the pre-investment stage, we help you define impact and measurement criteria and calculate risk adjusted returns. We also conduct an integral due diligence witch also includes environmental and social impact and risk analysis, team and leadership value analysis and create a gap report for you. We help investors to get their target investment-ready. We also identify high impact plus high return investment opportunities for you.

Beyond ESG and into impact investment we help to answer the most relevant question about early n opportunity recognition using our opportunity recognition framework.

At investment stage we control the fulfilment oft he Key Performance Indicators set and help our cleints to stay course. For secondary markets we use either ESG factors (see ESG) or help clients to identify investment opportunities into assets that fulfill the Sustainable Development Goals and the EU Taxonomy decide where best to invest. We integrate ESG into our data driven quantitative research, analysis and decision-making processes to provide you with the best advice.